If you run a sole proprietorship business, then there are a lot of perks for you. Yet, there is one thing that is missing–an employer-sponsored retirement plan. The good news is that a retirement plan for you is no longer missing, as there is something called Solo 401(k).

The IRS also calls the Solo 401(k) a one-participant 401(k). It is designed for self-employed workers and bears many of an employer-sponsored plan.

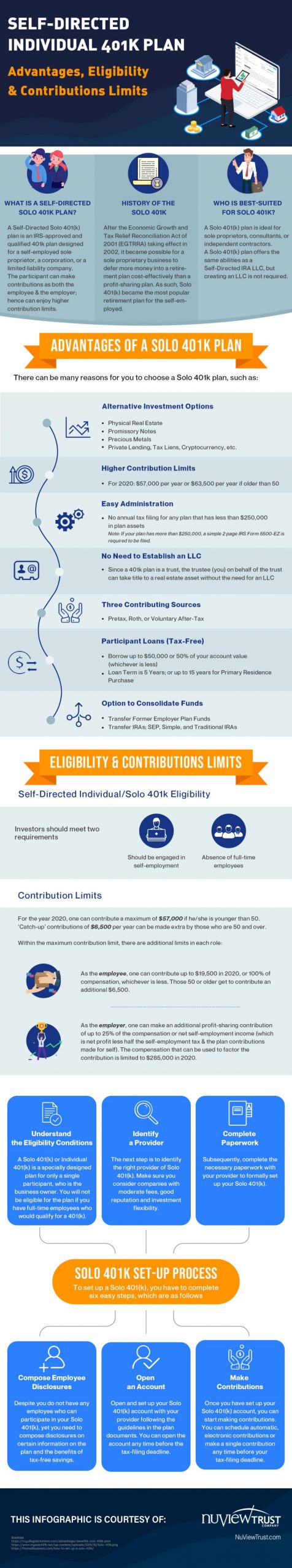

What is a Self-Directed Solo 401k plan?

A Self-Directed Solo 401(k) plan is an IRS-approved and qualified 401k plan designed for a self-employed sole proprietor or a business owner with no employees. And you need to avail services of a Solo 401(k) provider in opening an account.

History of the Solo 401K

The Solo 401(k) plan rose into prominence in 2002, after the Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA) went into effect. It became possible for a sole proprietary business to defer more money into a retirement plan cost-effectively than a profit-sharing plan. Eventually, the Solo 401(k) became the most popular retirement plan for the self-employed.

The Basics

It will help if you acquaint yourself with the basics of a Solo 401(k). The quick facts are as follows:

Eligibility Rules

There are no age or income restrictions. But you must be a business owner with no employees.

Contribution Limit

If you are younger than 50, the total contribution can be up to $57,000, as in 2020. And if you are 50 and above, you can make an additional $6,500 catch-up contribution.

Taxes on Contributions

For Traditional 401(k), you can make pre-tax contributions, and that will, however, reduce taxable income for the year.

For Roth 401(k), you can make after-tax contributions.

Taxes on Qualified Distributions in Retirement

While Qualified Distributions are taxed as income for Traditional 401(k), they are tax-free for Roth 401(k).

Refer to the infographic in this post to know more about a Solo 401(k).